February 24, 2022

Labour shortages, rising soybean prices and international conflict drive palm oil prices to new highs

1 RM (Malaysian Ringgit) = 0.24 USD

1 USD = 0.75 GBP

Crude Palm Oil

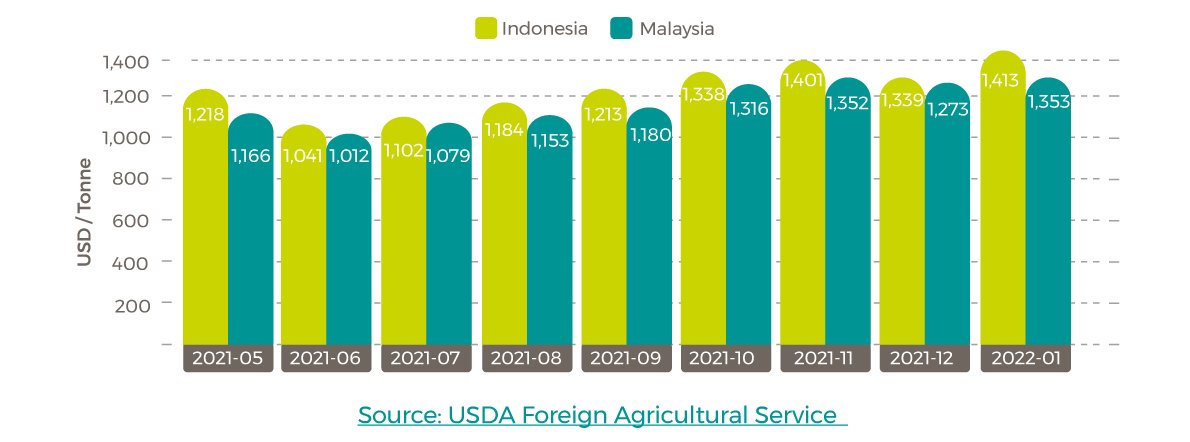

Average January Palm Oil Export Prices

-

Indonesia

$1,413/tonne (+$74/tonne) -

Malaysia

Malaysia $1,353/tonne (+$80/tonne)

Source: USDA Foreign Agricultural Service

Malaysia palm market

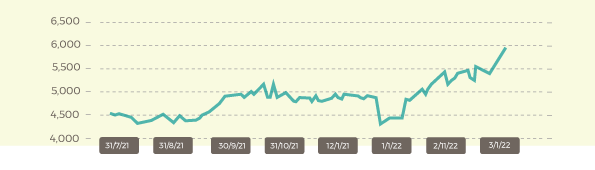

After a steep decline in Malaysia’s Crude Palm Oil (CPO) settlement price throughout December, dropping from 4,929 RM/tonne ($1,172.87) on December 7 to 4,295 RM/tonne ($1,022.01) by December 20, January gains more than reversed losses. Daily settlement price is the official daily closing price for a contract calculated each business day. Following December’s low, CPO rallied by 17% in the first week of 2022 with a settlement price of 5,036 RM/tonne ($1,198.33) by January 5. Prices have continued to strengthen, seeing a record high CPO settlement price of 6,455 RM/tonne ($1,535.99) on February 24.

In the USDA’s Foreign Agricultural Service oilseed report released on February 9, high prices seen throughout January were a result of tight vegetable oil supplies and rising soybean prices. According to industry analysts and economists, the escalating Russia-Ukraine crisis has been fuelling crude and edible oil markets, contributing to a surge in Malaysia’s palm oil futures. In an Economic Times article, Sathia Varqa Palm Oil Analytics in Singapore, said February exports have also outpaced production. According to reporting, the Malaysian Palm Oil Association estimated February production up to the 20th had fallen by 1.79%. The industry has struggled to keep up with production partially due to a shortage of labour. In October 2021, the Malaysian government announced it was lifting its migrant worker ban that was introduced as part of COVID-19 restrictions, with 32,000 entrants prioritised for the industry.

Malaysia palm prices CPO Settlement Price RM

Sime Darby December Market Report

Sime Darby, a Malaysian trading conglomerate and the world’s largest producer of Certified Sustainable Palm Oil released its latest bi-monthly market report on February 19.

Notable pull-outs:

- Malaysian palm supplies are expected to remain tight until the arrival of anticipated foreign workers

- India’s government announced a tax break on palm oil from 7.5% to 5%

- Starting February 23, a new Indonesian ruling requires domestic palm producers to sell 20% of production to domestic refiners at fixed prices. Long-term impact on supply to the global market remains to be seen. Short-term disruption, upwards of two months, expected as exporters work to fulfil required domestic sales.

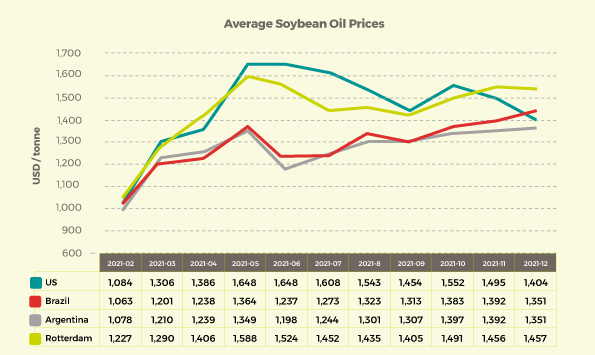

Soybean oil

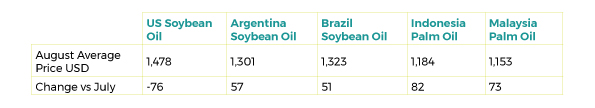

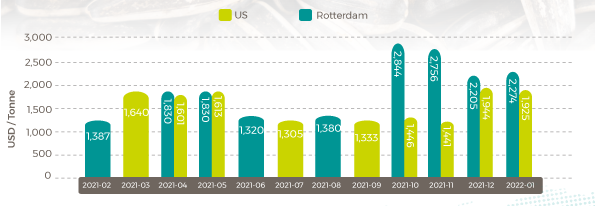

January 2022 Soybean Oil Export Prices $/tonne

Dry weather conditions seen throughout South America in the last two months has had a significant impact on forecasted soybean yields and production. In May 2021, USDA forecasted record production for Argentina, Brazil and Paraguay. As of December 2021, forecasts were decreased by 18 million tonnes: Argentina -9%, Brazil -7%, Paraguay -37%. According to USDA, global trade is down on weaker demand from China and Egypt. From October to December 2021, imports from China were down 13% from the previous year.

Rapeseed oil

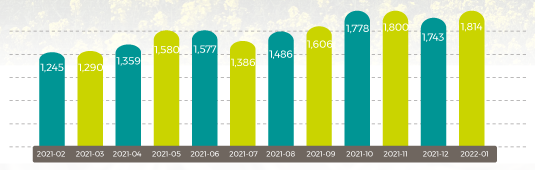

Average Rapeseed Rotterdam (Canola) Oil Prices

Sunflower oil

Average 2021 Sunflower Seed Oil Prices

Sime Darby noted concern on Black Sea sunflower supplies as a consequence of the Russia and Ukraine conflict. This could result in a decrease in sunflower oil exports, resulting in further global supply shortages.

Shipping update

2022 container shipping outlook predicts another year of high prices

In a 2022 outlook by FreightWaves and American Shipper, Prices are expected to remain expensive throughout 2022 for ocean shippers. 2022 annual contract rates have increased, up 122% from 2020’s pre-COVID period. Early negotiations saw forty-foot containers averaging $5,700. The outlook outlines scenarios for key unknowns going into the new year and “wild cards” which include COVID, port labour negotiations and geopolitical tensions over Taiwan. The outlook outlines scenarios for key unknowns going into the new year and “wild cards” which include COVID, port labour negotiations and geopolitical tensions over Taiwan.

The full report can be read here.

Investigation launches into shipping lines behaviour during supply chain crisis

Five competition authorities, including the US Department of Justice, Canadian Competition Bureau, the Australian Competition and Consumer Commission, the New Zealand Commerce Commission and the UK Competition and Markets Authority, are launching an investigation into alleged exploitative behaviour during the ongoing supply chain crisis.

FreightWaves reports, “Many buyers of ocean transportation say the carriers have manipulated tight capacity during the pandemic through deferred and cancelled sailings, and other measures, to drive rates up, resulting in record profits estimated to top $200 billion last year. A combination of antitrust immunity, a dozen years of consolidation that has left eight major carriers partnering in three alliances and an expansion into broader logistics services and control of data has enabled the largest carriers to dominate the market.”

Disclaimer: The information in this document has been obtained from or based upon sources believed to be reliable and accurate at the time of writing. The document should be for information purposes only and is not guaranteed to be accurate or complete.