Smaller stocks mean a rise in palm and sunflower oil prices, but a larger South American harvest pushes down soyoil prices

1 RM (Malaysian Ringgit) = 0.21 USD

1 USD = 0.79 GBP

*Exchange rates calculated and market prices reported on February 29 2024

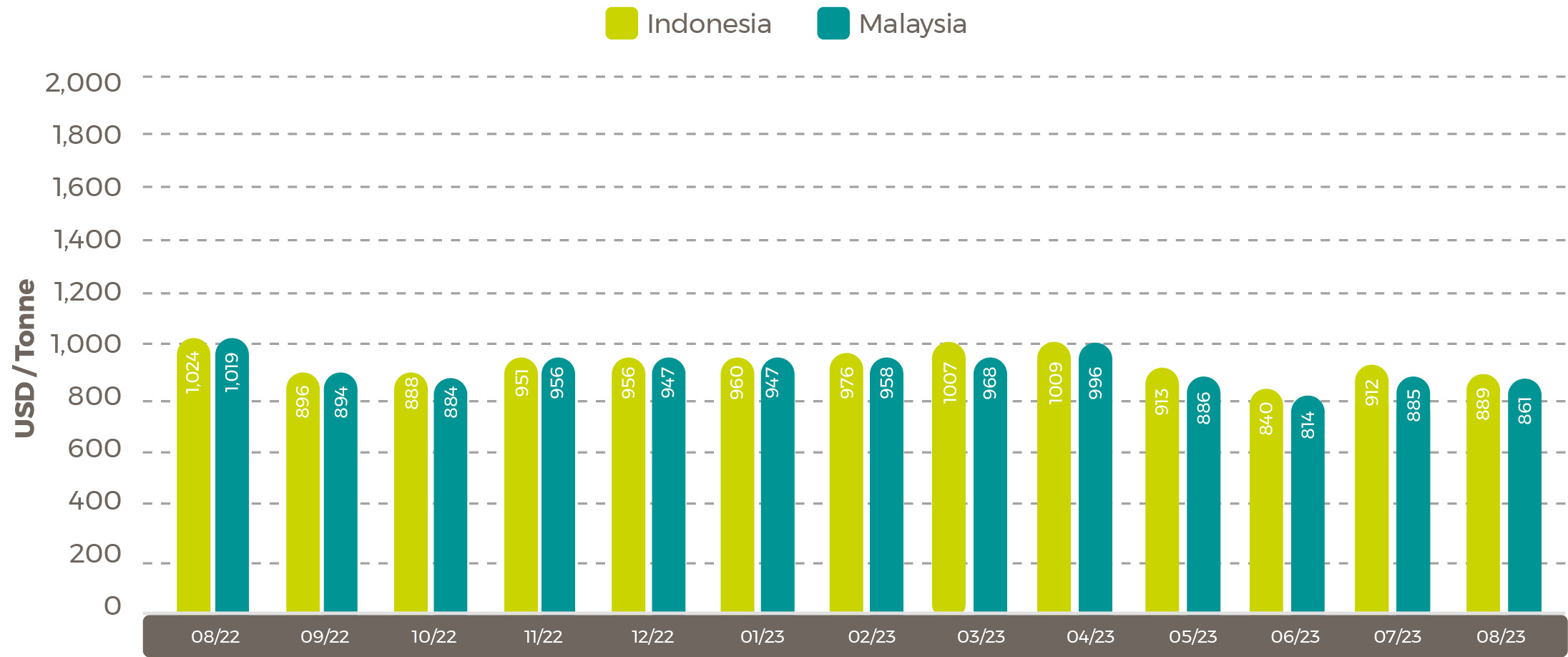

Crude Palm Oil

Average February Palm Oil Export Prices

-

Indonesia

$880 tonne (+$25/tonne) -

Malaysia

$845/tonne (+$20/tonne)

Source: USDA Foreign Agricultural Service

Malaysia palm market

Malaysian crude palm oil prices strengthened throughout January, driven by stronger demand and smaller stocks, although they ended the month on a weak note. The average value for the month was 3,828 RM/tonne, which was 2.2% more than the average December 2023 price, but 2.8% lower than the January 2023 average.

The opening January price was 3,621 RM/tonne. By January 26 it has jumped by 10.9% to 4,015 RM/tonne. That was the highest price since the beginning of September 2023. However, in the last five days of the month, the price fell to 3,828 RM/tonne.

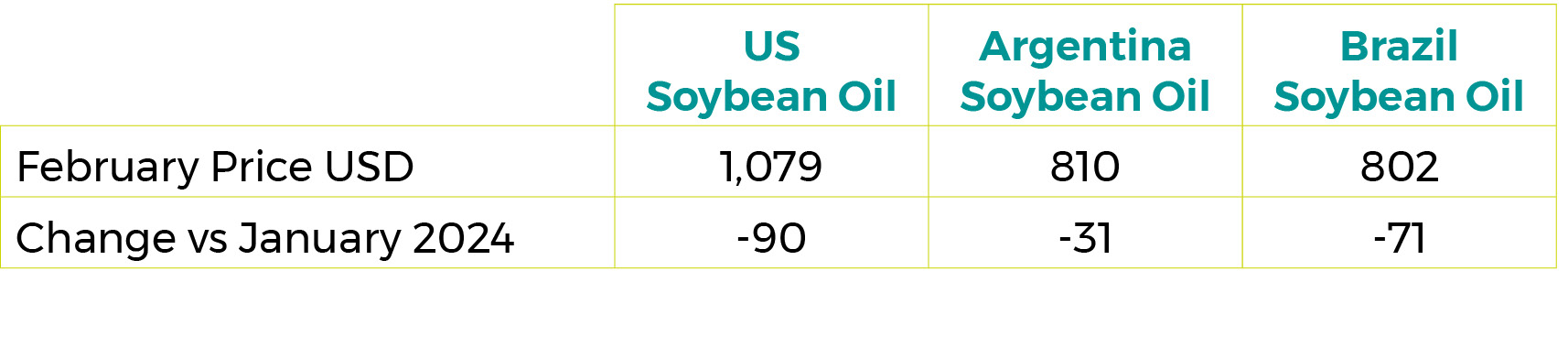

Soybean oil

February 2024 Soybean Oil Export Prices $/tonne

Prices slip, but oilseed production expected to increase

Faster than expected progress of the Brazilian soybean harvest and weak Asian demand have pushed global soybean prices down. During February Brazilian and Argentinian soybean oil was trading at three-year lows, putting pressure on US and other soybean prices. Reduced stocks of Malaysian palm oil and Black Sea sunflowerseed oil supported prices of those oils.

The US Department of Agriculture modified its expectations for 2024 in its February report.

“The global oilseeds production forecast is lowered this month to 659 million tons on large reductions in Brazil soybean and China sunflowerseed crops, more than offsetting higher Bolivia soybean and India rapeseed crops. Global oilseeds trade is down slightly to 197 million tons on lower U.S. soybean exports, despite higher Brazil soybean exports. Ending stocks are up more than 2 million tons due to increases in U.S. and Brazil soybean and Australia rapeseed ending stocks.

Oilseed crush is down slightly on lower China sunflowerseed and Vietnam soybean processing with increases in India rapeseed and soybean crush. Global protein meal exports are forecast up on higher exports of soybean and rapeseed meal from India. Vegetable oil trade is slightly down on lower Malaysia palm oil exports. The projected U.S. season-average farm price for soybeans is lowered 10 cents to $12.65 per bushel.”

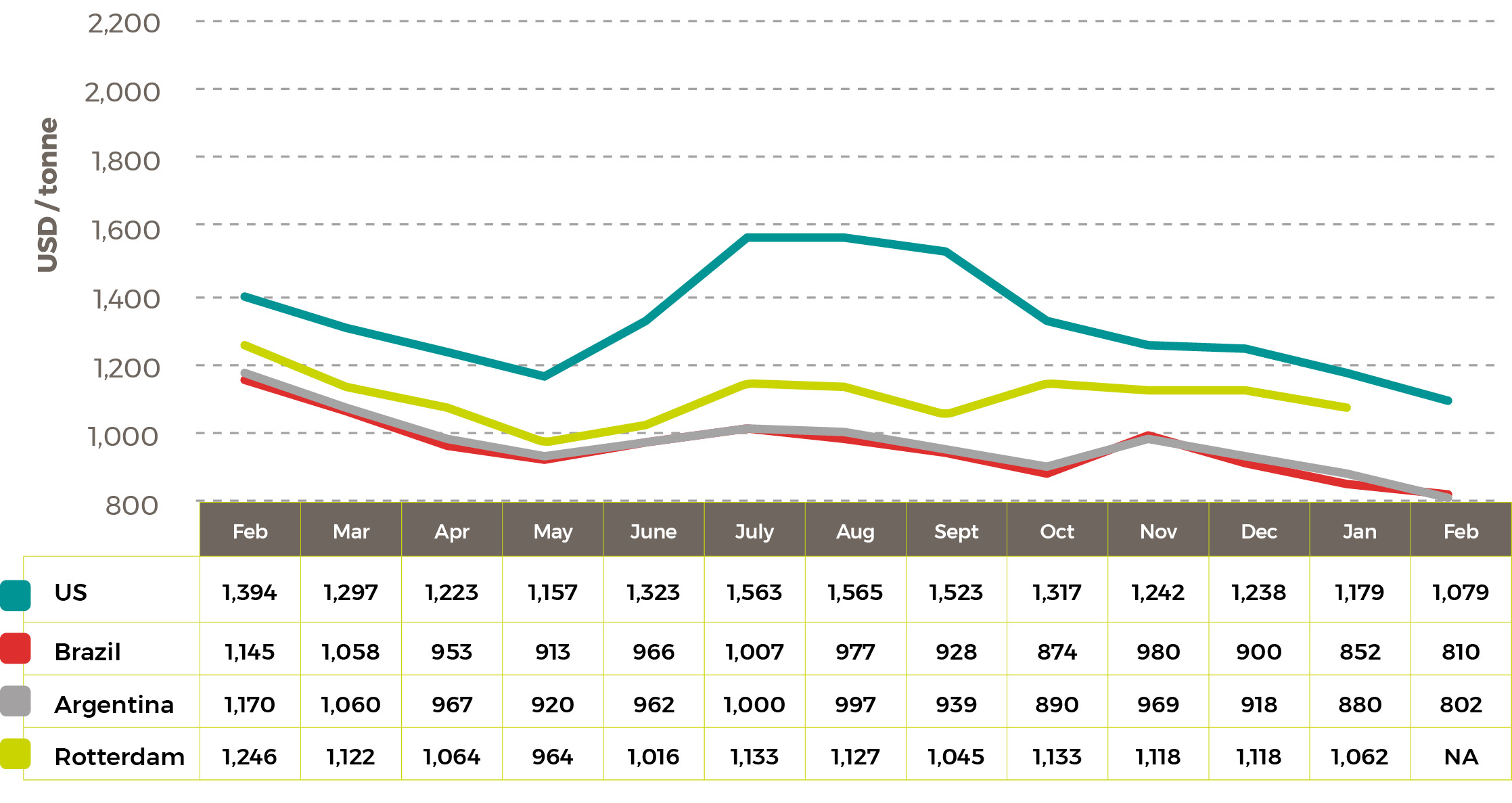

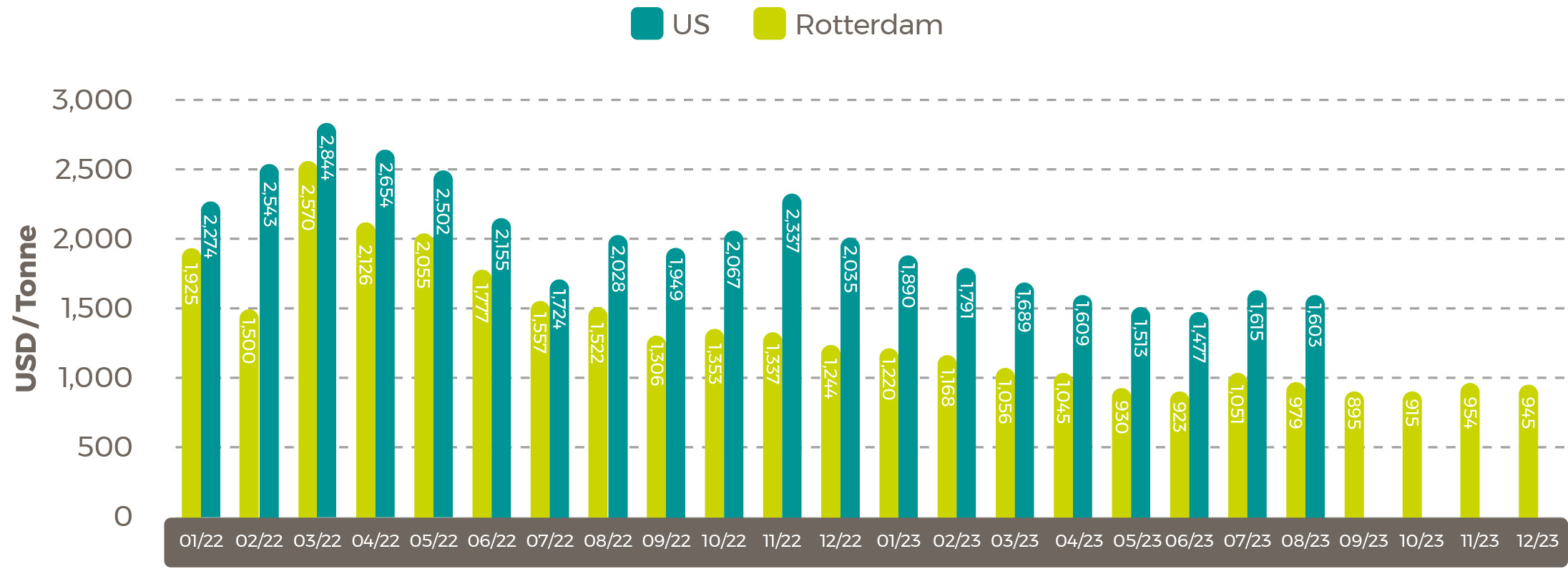

Average 2022/24 Soybean Oil Prices $/tonne

Rapeseed oil

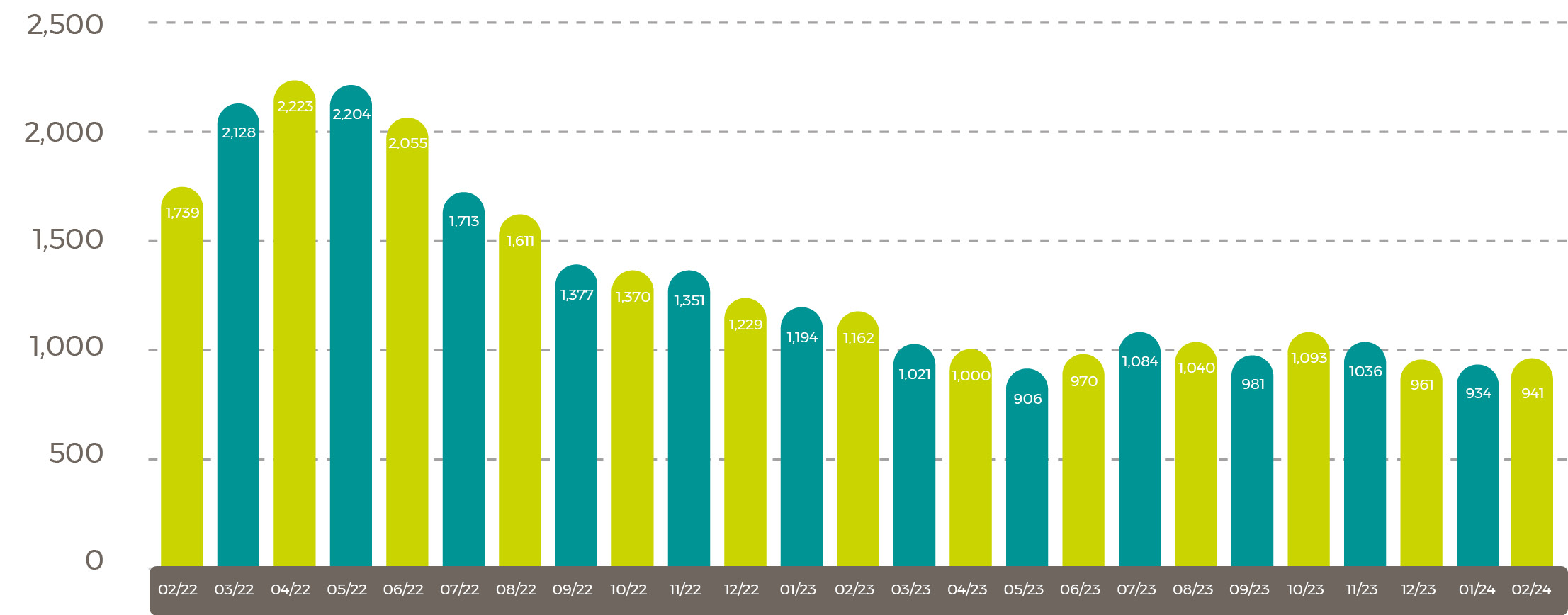

Average 2022/24 Rapeseed Rotterdam (Canola) Oil Prices $/tonne Sunflower oil

Sunflower oil

Average 2022-24 Sunflower Seed Oil Prices $/tonne

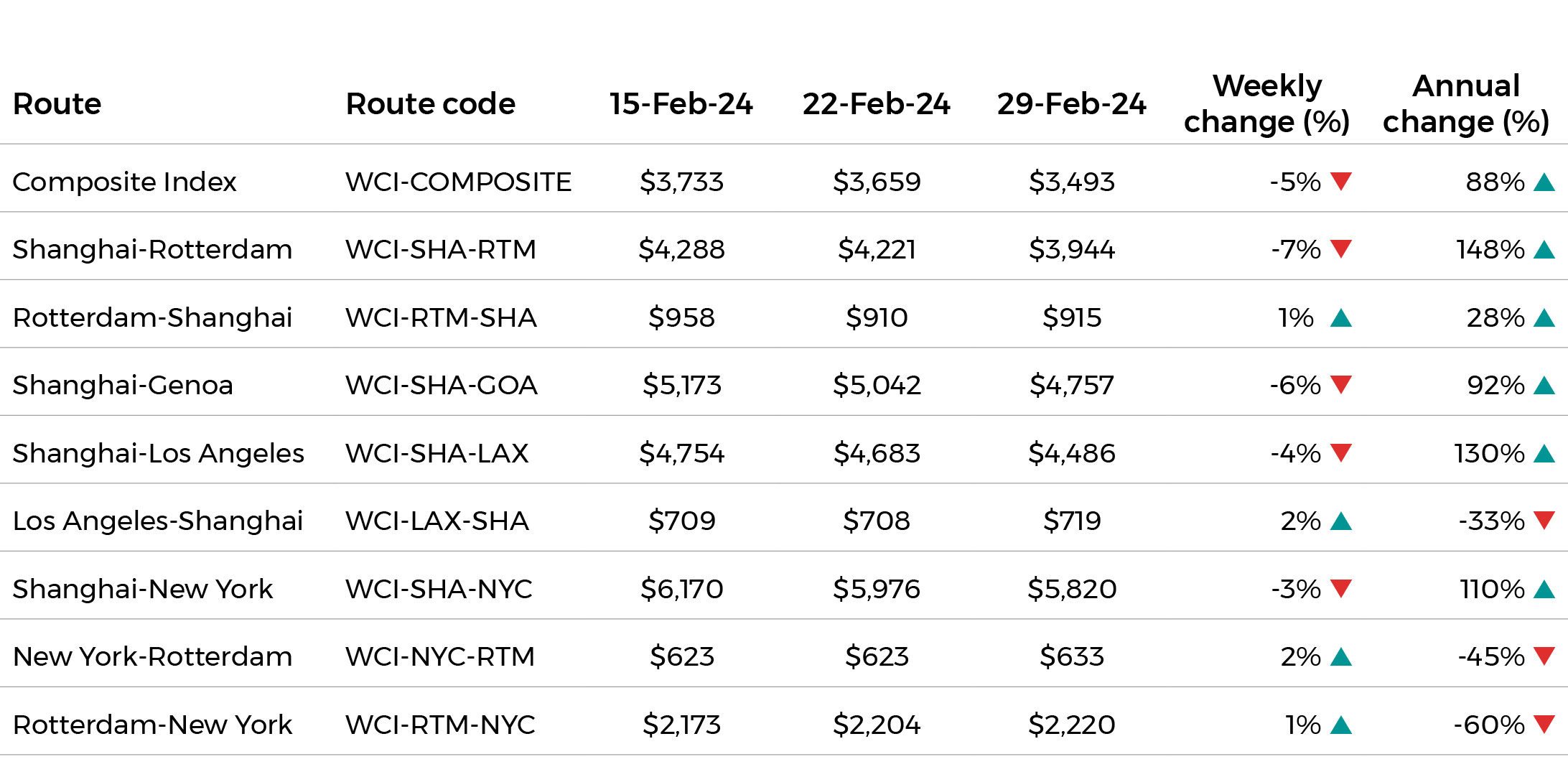

Shipping Update

A small easing in shipping costs, but Middle East Tension keeps prices high

Continuing tension in the Middle East meant that shipping costs remain high, although they have fallen by 5% in the last week.

From the February 29 2024, Drewry World Container Index report:

-

The composite index decreased by 5% to $3,493 per 40ft container this week and has increased by 88% when compared with the same week last year.

-

The latest Drewry WCI composite index of $3,493 per 40ft container is 146% more than average 2019 (pre-pandemic) rates of $1,420.

-

The average composite index for the year-to-date is $3,553 per 40ft container, which is $859 higher than the 10-year average rate of $2,694 (which was inflated by the exceptional 2020-22 Covid period).

-

Freight rates on Shanghai to Rotterdam decreased 7% or $277 to $3,944 per 40ft box. Likewise, rates from Shanghai to Genoa dropped 6% or $285 to $4,757 per feu. Followed by rates on Shanghai to Los Angeles which declined 4% or $197 to $4,486 per 40ft container. Similarly, rates from Shanghai to New York dropped 3% or $156 to $5,820 respectively. Conversely, rates on Los Angeles to Shanghai and New York to Rotterdam increased 2% or $11 and $10 to $719 and $633 per 40ft box. Likewise, rates Rotterdam to Shanghai and Rotterdam to New York swelled 1% or $5 and $16 to $915 and $2,220 per feu. Drewry expects slight decreases in spot rates from China over the next few weeks.

View Drewry shipping data here.

Disclaimer: The information in this document has been obtained from or based upon sources believed to be reliable and accurate at the time of writing. The document should be for information purposes only and is not guaranteed to be accurate or complete.