March, 18 2022

Global oilseed market disrupted as South America faces drought and Russia-Ukraine conflict escalates

1 RM (Malaysian Ringgit) = 0.24 USD

1 USD = 0.76 GBP

Crude Palm Oil

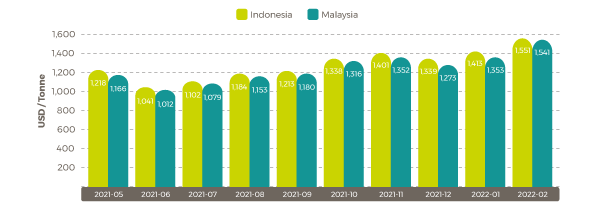

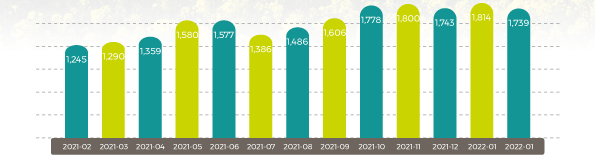

Average February Palm Oil Export Prices

-

Indonesia

$1,551/tonne (+$138/tonne) -

Malaysia

$1,541/tonne (+$188/tonne)

Source: USDA Foreign Agricultural Service

Malaysia palm market

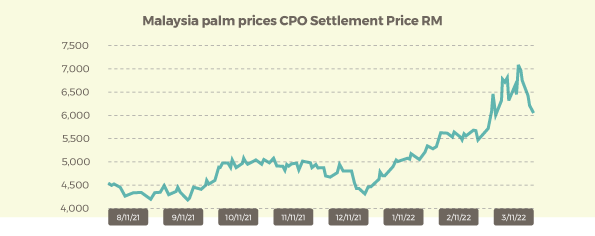

Malaysia’s Crude Palm Oil (CPO) settlement continued to make gains throughout the end of February and into the first part of March, hitting a new record high of 7,074 RM/tonne ($1,684.97) on March 9. Starting the year off at 4,857 RM/tonne ($1,156.90), CPO settlement price began a gradual increase for a January average of 5,170 RM/tonne ($1,231.45). A combination of decreased production due to labour shortages and global commodity market uncertainty surrounding the Russia-Ukraine war has been the key driver behind accelerating prices. Throughout February, CPO settlement price averaged 5,713 RM/tonne ($1,360.79) seeing a high of 6,453 RM/tonne ($1,537.05) on February 24, the day Russia invaded Ukraine. Starting the month of March off at 6,762 RM/tonne ($1,610.65), CPO jumped 312 RM/tonne ($74.32) in seven days for the record high. At the time of writing the Volac Wilmar Feed Ingredients Commodity Market Report on March 16, CPO settlement price has since seen a steady decline since March 9, dropping 1,010 RM/tonne ($240.57) for a price of 6,064 RM/tonne ($1,444.39) on March 16. This is still well above the 2022 average CPO settlement price of 5,701 ($1,357.93).

Malaysia palm prices CPO Settlement Price RM

Uncertainty in oilseed and product exports disrupts the market

Drought conditions in South America have decreased soybean production by nearly 2% in Brazil, Argentina, Paraguay and Uruguay, says USDA’s Foreign Agricultural Service oilseed report released on March 9. With this adding pressure to the global oilseed market, port and crush processing facilities suspending operations in Ukraine and sanctions on Russia have caused further upset. According to the USDA, Russia, and Ukraine collectively account for 80% of global sunflower meal and sunflower oil trade, 20% of rapeseed exports and 15% of rapeseed

oil exports. In USDA’s short-term impact analysis, seed exports are down 57 percent, oil exports are down 14 percent, and meal exports are down 13 percent. “As a result, Ukraine sunflower seed ending stocks are up nearly seven-fold this month to 1.9 million tons. Similarly, domestic consumption (feed and waste) has more than tripled this month on an increase in damaged and spoiled product as well as increased full-fat feeding while meal production is halted,” USDA reports. “In Russia, export reductions are more muted with exporters facing uncertainties in Black Sea shipping routes and the impacts of sanctions. Russia exports are down 33 percent for sunflower seed, 4 percent for sunflower seed oil, and 3 percent for sunflower seed meal.” Russia and Ukraine only account for 9% of global vegetable oil consumption. However, this still has had a knock-on effect on the palm market. According to an analysis by S&P Global, Malaysian palm orders surged from Indian buyers due to uncertainty in sunflower oil shipments out of Ukraine. “Ukraine accounts for 46% of the world’s sunflower oil exports and the ongoing war represents a significant disruption to the global edible oils trade flows as the market was looking for an increase in sunflower oil exports from Ukraine to partially relieve the current tight supply in global edible oil markets,” S&P Global reported.

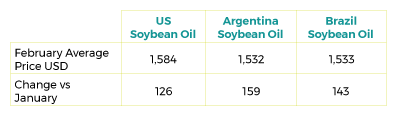

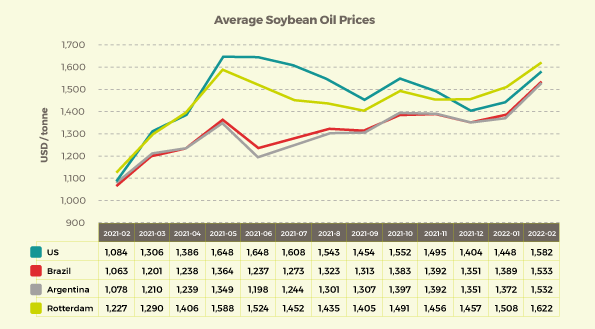

Soybean oil

February 2022 Soybean Oil Export Prices $/tonne

Soybean prices continue to increase as forecasted production in South America decreases due to persistent drought conditions. Soybeans, meal and oil have also been impacted by uncertainty in the sunflower seed market. According to USDA, “the May contract on the Chicago Board of Trade has risen 38 percent since early December, or nearly $4.70/bushel, to $17.07 on March 8. The November contract for new-crop soybeans has risen at a more modest pace (21 percent), adding nearly $2.60/bushel to the contract price since early December. This has led to a widening premium for old-crop soybeans versus new-crop in the United States. Premiums that were near 2 percent in November 2021 are currently 15 percent in early March.” This has resulted in the selling of stocks rather than holding them into the next harvest this Autumn.

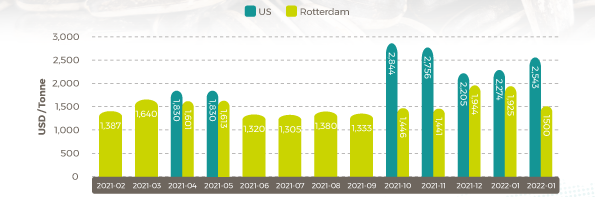

Rapeseed oil

Average Rapeseed Rotterdam (Canola) Oil Prices

Sunflower oil

Average 2021 Sunflower Seed Oil Prices

Shipping update

Ship fuel spikes to historic $1,000/ton mark as war fallout worsens

On March 4, American Shipper reported that fuel prices for ocean freight liners had surpassed $1,000/ton. In compliance with IMO 2020 environmental regulations, ships are required to use very low sulphur fuel oil (VLSFO) which is more expensive with a 0.5% sulphur content. “The average price of VLSFO at the world’s top 20 bunker (marine fuel) ports reached $987 per ton on Tuesday, up 84% year on year. In two of the top four ports — Singapore and Fujairah, United Arab Emirates — the price of VLSFO reached $1,001 and $1,024 per ton, respectively. These price levels are unprecedented,” wrote American Shipper Senior Editor Greg Miller.

The full report can be read here.

Covid curb bite at Chinese ports, threatening global supply chains

An outbreak of COVID-19 infections in China is leading to congestion in Chinese ports due to labour shortages. As reported by Reuters, “Container loading is ‘decreasing massively’ at Shenzhen’s Yantian port, the world’s fourth-largest container terminal, as port workers, truckers and factory workers stayed at home.” As of March 16, there were 34 vessels at Shenzhen and 30 vessels at Qingdao waiting to dock. A year ago, there were seven in waiting at each respective port. “This implies that it will become difficult to get cargo to and from the ports and hence whether the terminals are open or not becomes a moot point,” said Lars Jensen, CEO at Vespucci Maritime, a container shipping advisor. “It will have a disruptive impact on the supply chain - in turn prolonging the current supply chain crisis.”

The full report can be read here.

Russia-Ukraine war’s impact on global logistics

Rabobank, a global food and agribusiness bank, released an analysis on the impact the Russia-Ukraine war is having on global logistics.

Key ocean freight takeaways:

- Major carriers including Ocean Network Express, Hapag-Llyod, MSC, Maersk and CMA CGN have suspended new bookings to and from Russia and Ukraine

- Re-routing Russian ships and extra custom inspections are expected to increase European port congestion

- Shipping prices are expected to increase as lines pass on rising ocean freight insurance and fuel costs

- Nearly 15% of seafarers are Russian and Ukrainian. While they currently remain free from sanctions, blockage at ports and operational challenges such as paying seafarers is expected to cause labour shortages

The report also analyses rail, air and road freight. Read it in full here.

Disclaimer: The information in this document has been obtained from or based upon sources believed to be reliable and accurate at the time of writing. The document should be for information purposes only and is not guaranteed to be accurate or complete.