March, 30 2022

Despite recent decline, CPO prices expected to remain strong

1 RM (Malaysian Ringgit) = 0.24 USD

1 USD = 0.76 GBP

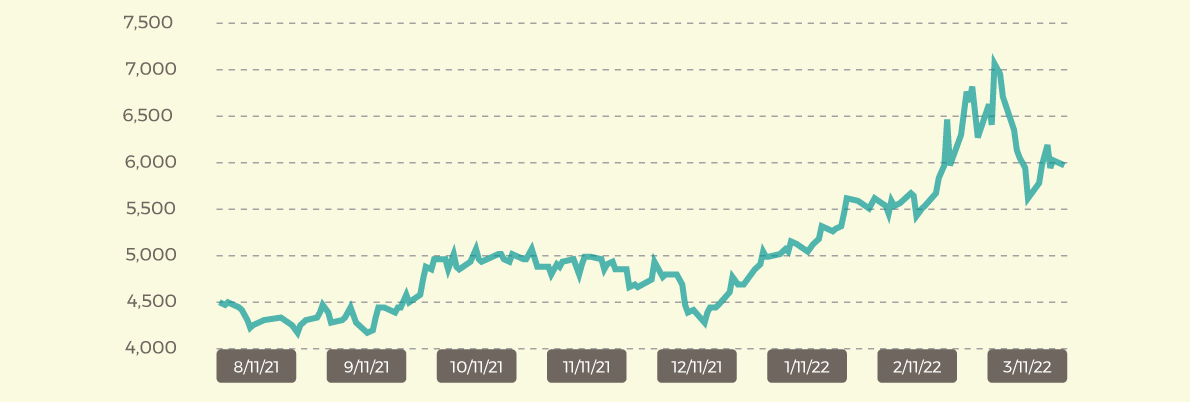

Following a sharp decline that started March 9, Malaysia’s Crude Palm Oil (CPO) settlement price has begun to regain ground in the final days of March.

Seeing a 29-day low at the end of the drop on March 18 of 5,629 RM/tonne ($1,755.34), the settlement price jumped to 6,192 RM/tonne ($1,469.56) by March 23. Prices have slightly weakened, levelling off at 5971 RM/tonne ($1,417.11) on March 28.

Malaysia palm prices CPO Settlement Price RM

The sudden drop in prices has been attributed to a combination of weak March exports and the fall of Malaysian palm oil futures from China’s recent announcement of a nine-day COVID-19 lockdown in Shanghai. The lockdown brought major transportation infrastructure to a halt, decreasing fuel demands.

An economist at Mumbai-based vegetable oils broker Sunvin Group foresees palm oil prices to remain lifted as South American soybean production is hampered by an ongoing drought and the Black Sea region struggles with supply bottlenecks for sunflower oil.

The full report can be read here.

Also attributing to market shift has been a recent move by Indonesia’s government to raise its maximum palm export levy.

“The new regulation, which took effect immediately, introduced higher progressive rates when the reference price for the edible oil hit at least $1,050 a tonne to a maximum levy of $375 a tonne. Under previous rules, the maximum export levy was $175 per tonne, which kicked in when the reference price hit at least $1,000 a tonne. Indonesia's reference crude palm oil price for March stood at $1,432.24 per tonne,” reported Reuters.

The full report can be read here.

Disclaimer: The information in this document has been obtained from or based upon sources believed to be reliable and accurate at the time of writing. The document should be for information purposes only and is not guaranteed to be accurate or complete.