April, 19 2022

Shanghai lockdown and Russia-Ukraine war disrupt oilseed and freight markets

1 RM (Malaysian Ringgit) = 0.24 USD

1 USD = 0.76 GBP

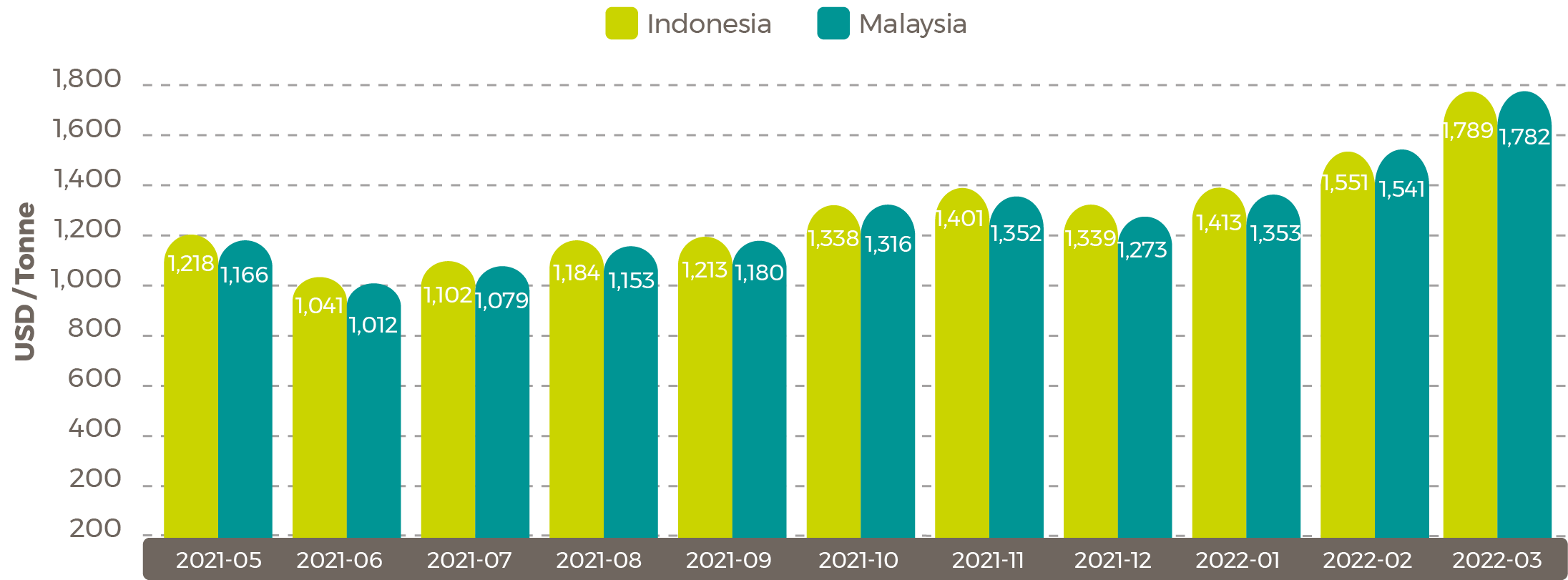

Crude Palm Oil

Average March Palm Oil Export Prices

-

Indonesia

$1,789/tonne (+$238/tonne) -

Malaysia

$1,782/tonne (+$241/tonne)

Source: USDA Foreign Agricultural Service

Malaysia palm market

As reported in the Volac Wilmar Feed Ingredient March Palm Update, Malaysia’s Crude Palm Oil (CPO) settlement price saw a decrease of 1,445 RM/tonne ($341.57) from March 9 to March 18, finishing off the remainder of the month at an average of 5,947 RM/tonne ($1,405.74).

The sudden price drop is attributed to a combination of weak March exports and the fall of Malaysian palm oil futures from China’s COVID-19 lockdown in Shanghai. The lockdown brought major transportation infrastructure to a halt, decreasing fuel demands. Also attributing to the market shift has been a recent move by Indonesia’s government to raise its maximum palm export levy.

CPO settlement price made gains throughout April, starting the month off at 5,566 RM/tonne ($1,315.68) on April 1, steadily increasing to 6,136 RM/tonne (1,450.42) by April 13. Recovering prices are being driven by India as its palm oil imports have increased from the country securing sunflower oil alternatives, reports Reuters. The Solvent Extractor’s Association of India says imports for March were 539,793 tonnes of palm oil, up from 454,794 tonnes in February.

The CPO market is tied to the global vegetable oil market, which has seen an increase in prices from tight supplies due to drought impacting South America’s soybean crop and losses in Ukrainian sunflower oil.

Malaysia palm prices CPO Settlement Price RM

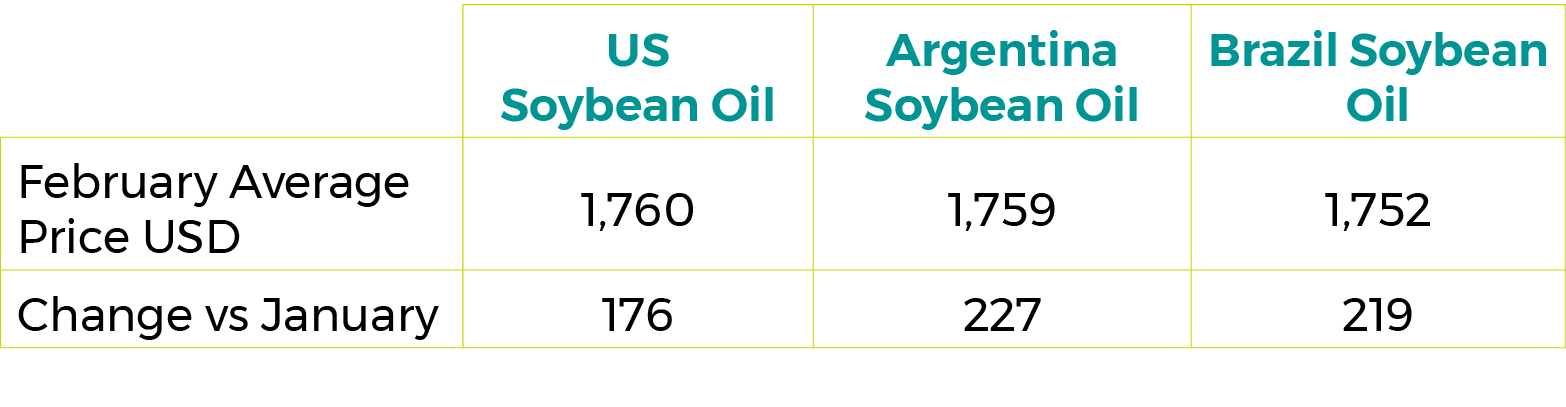

Soybean oil

March 2022 Soybean Oil Export Prices $/tonne

Top soybean producing countries Argentina, Brazil and the US all had saw monthly average prices hit multi-decade hights. According the USDA, lingering impacts of the drought in South America plus events in the Black Sea region were the primary drivers. Prices peaked in mid-March and declined as markets adjusted to weakening demand due to higher prices and slowing soybean crush in China. Through the first half of 2021/22, soaring feed costs and low meat prices led to reduced soybean crush levels in China, nearly to levels seen during the African Swine Fever outbreak in 2018/19.

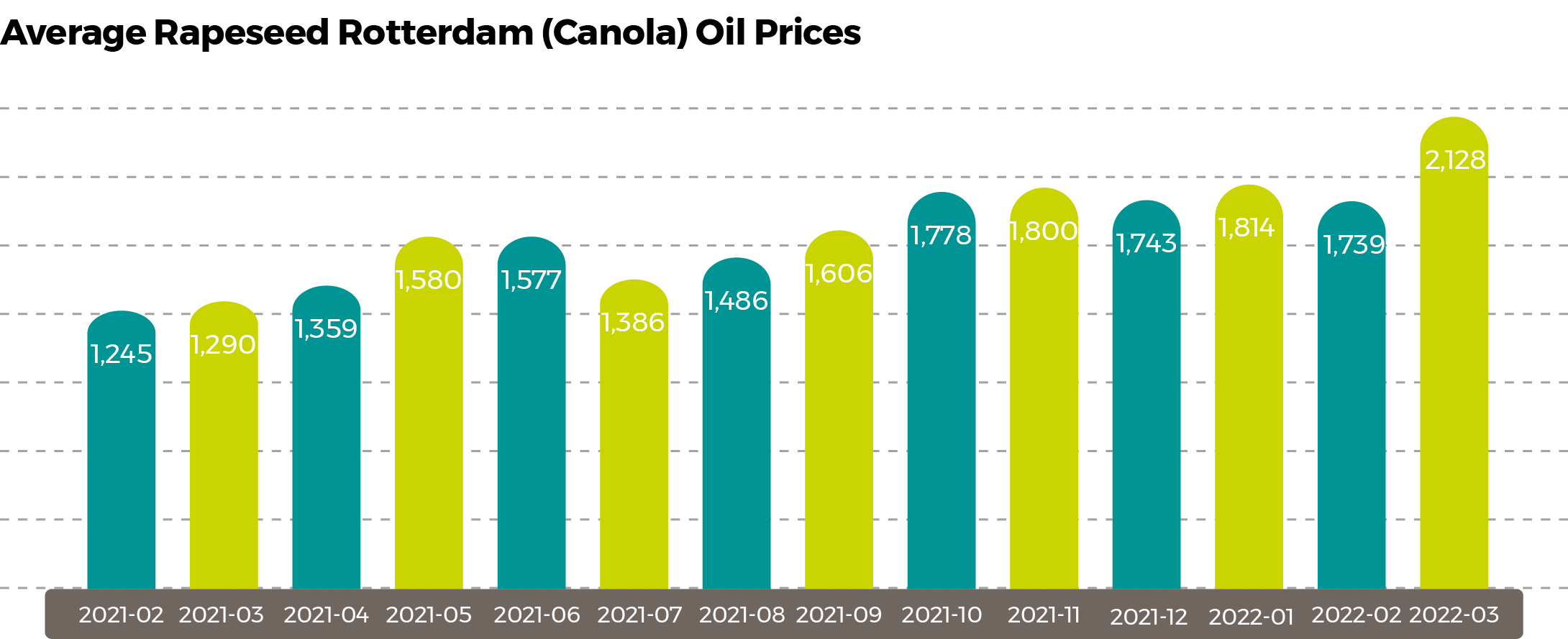

Rapeseed oil

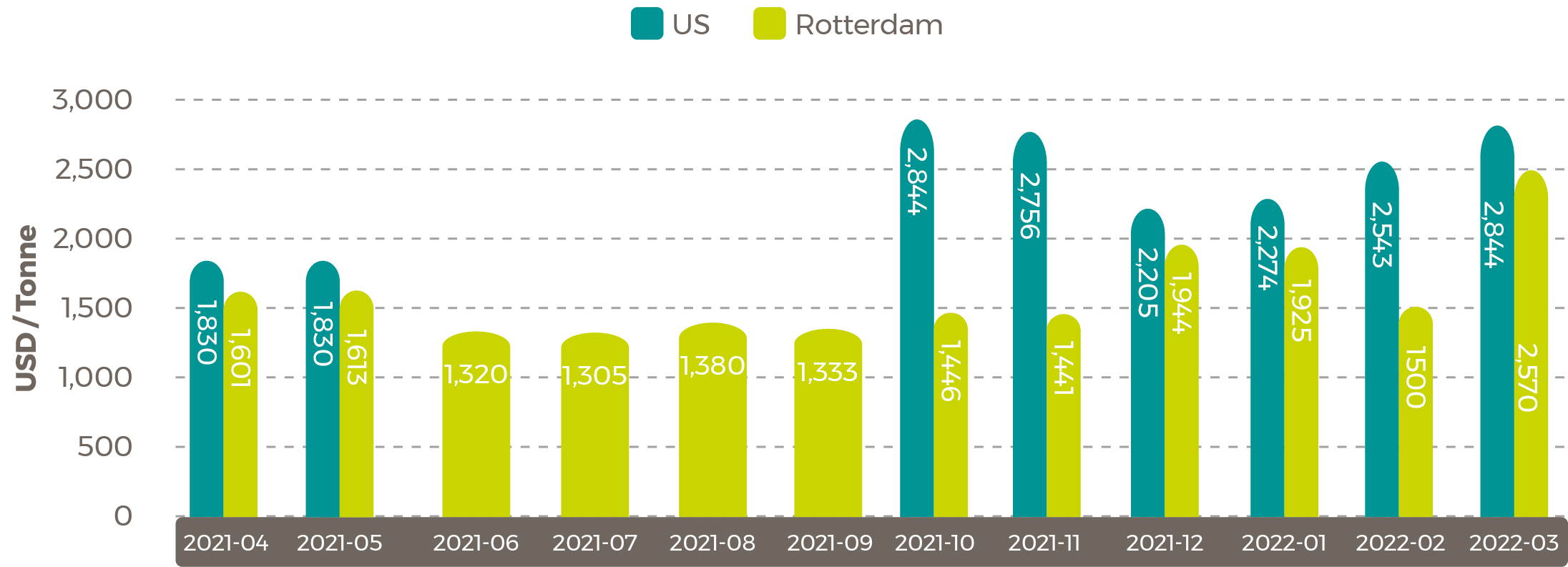

Sunflower oil

Average Sunflower Seed Oil Prices

Shipping update

China port congestion leaves everything from grains to metals stranded

Following the start of Shanghai’s city-wide COVID-19 lockdown at the end of March, multiple Chinese ports are dealing with cargo ship congestion. As of April 12, there was a reported 477 bulk cargo ships waiting to deliver raw material shipments ranging from grain to metal into different ports.

Shanghai alone had 222 ships waiting as of April 11, with Bloomberg shipping data indicating a 15% increase since mid-March. The lockdown driven congestion led ships to divert to other Chinese ports, resulting in 134 carriers waiting at Ningbo-Zhoushan and a collective 121 ships at Rizhao, Dongjiakou and Qingdao ports.

“A shortage of port workers at Shanghai is slowing the delivery of documentation needed for ships to unload cargoes, according to ship owners and traders. Meanwhile, vessels carrying metals like copper and iron ore are left stranded offshore as trucks are unable to send goods from the port to processing mills,” reports Bloomberg.

The full report can be read here.

Shipping companies in the Black Sea face war-risk premiums as high as $5 million

Vessels traveling through the Black Sea are faced with premiums upwards of 10% of the vessel’s value due to the heightened risk of striking mines, being detained or becoming subject to missile attacks as part of the war between Russia and Ukraine.

The Black Sea is a key route for oil and bulk food exports, reports Business Insider, with multiple ships struck by explosives or being used as shields by Russian forces.

“Before Russia's attack on Ukraine, there was almost no additional cost for ships in the Black Sea. But, now Bloomberg reports that the additional insurance cost would amount to about $5 million for a standard tanker worth about $50 million — 30% higher than the cost of hiring the ocean carrier itself,” reports Business Insider.

The full report can be read here.

Some indexes showing falling trans-Pacific rates but signals still mixed

Global sea freight rates weakened in March leaving economists searching for answers at the cause of the slow-down as the global economy continues to grapple with surging inflation, COVID-19 restrictions, congestion and the Russia-Ukraine war.

Greg Miller, senior editor of FreightWaves and American Shipper, did a deep dive into this speaking to economists and reviewing reports from Drewry, Flexport, S&P Global Commodity Insights and Xeneta.

Key ocean freight takeaways:

- S&P Global Platts currently assesses Asia-West Coast rates at $8,000 per forty-foot equivalent unit, not including premium surcharges. That’s down 16% from $9,500 per FEU in early March. While there is a seasonal post-Lunar New Year lull, this has decreased more than normal

- In contrast, Platts currently puts Asia-East Coast rates at an-all time peak of $12,000 per FEU, up 10% year to date

- The weekly Drewry assessment for Shanghai to Los Angeles came in at $8,824 per FEU on Thursday, April 7. That was down 20% from $10,986 in early March

- Drewry put the Shanghai to New York rate at $11,303 per FEU, down 19% from a January high of $13,987 — the opposite of the rising trend reported by Platts

- Xeneta puts the Far East-West Coast spot rate at $8,752 per FEU, plus optional premiums of $1,967-$5,503. This is up 9% from $8,021 on Jan. 2, the opposite of the downward trend on this route shown by Drewry and Platts

- The Freightos Baltic Daily Index (FBX) — which shows higher rates than others because it includes premiums in its trans-Pacific assessments — was at $15,817 per FEU on Thursday for the Asia-West Coast route. That’s up 15% year to date. The Drewry assessment for this lane is down 21% year to date

Read the article in full here.

Disclaimer: The information in this document has been obtained from or based upon sources believed to be reliable and accurate at the time of writing. The document should be for information purposes only and is not guaranteed to be accurate or complete.