September 22, 2021

Palm prices increase despite being expected to remain firm throughout September

1 RM = 0.24 USD

1 USD = 0.72 GBP

Crude Palm Oil

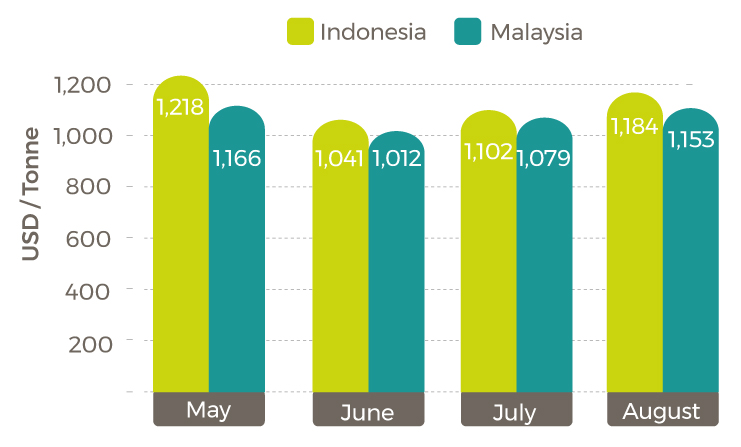

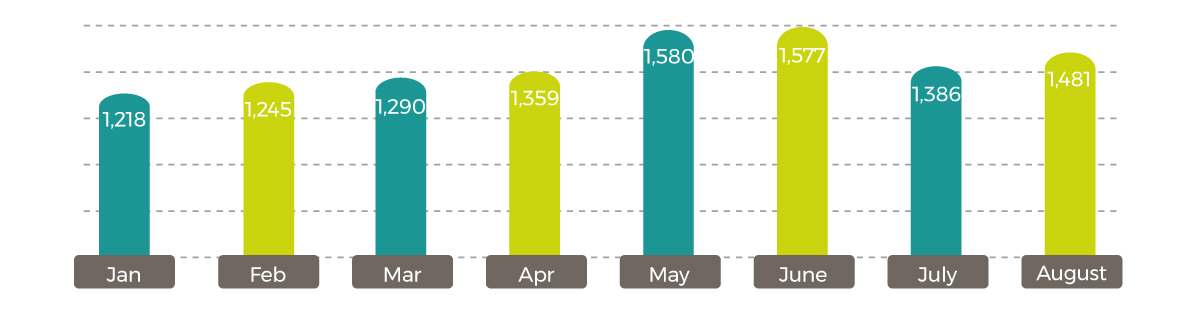

Average August Palm Oil Export Prices

-

$1,184/tonne (+$82/tonne from July)

-

$1,153/tonne (+$73/tonne from July)

Malaysia palm market

Malaysia palm market

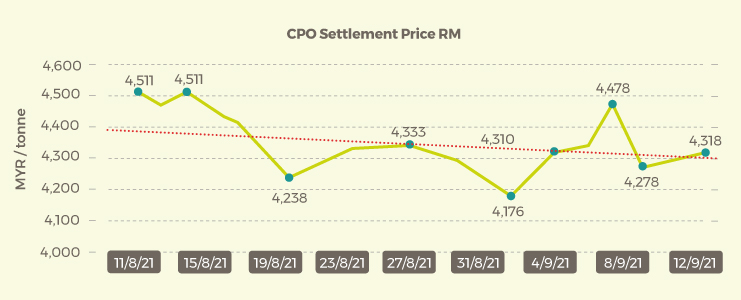

Following a downward trend since mid-August, CPO settlement price ended on a low at the start of September before a five-day rally.

- September 1 CPO settlement price 3,710 RM/tonne ($889.08)

- September 8 CPO settlement price 4,478 RM/tonne ($1073.12)

- September 13 CPO settlement price 4,318 RM/tonne ($1039.36)

Malaysian Palm Oil Council reported on September 6 that global trading

firm CGS-CIMB speculated CPO prices to remain between 3,500-4,000 RM/tonne throughout the month following a decrease in August exports. The global CPO market has experienced price volatility following COVID-19 related labour shortages and transportation challenges on top of Northern America and India weather events tightening edible oil supplies.

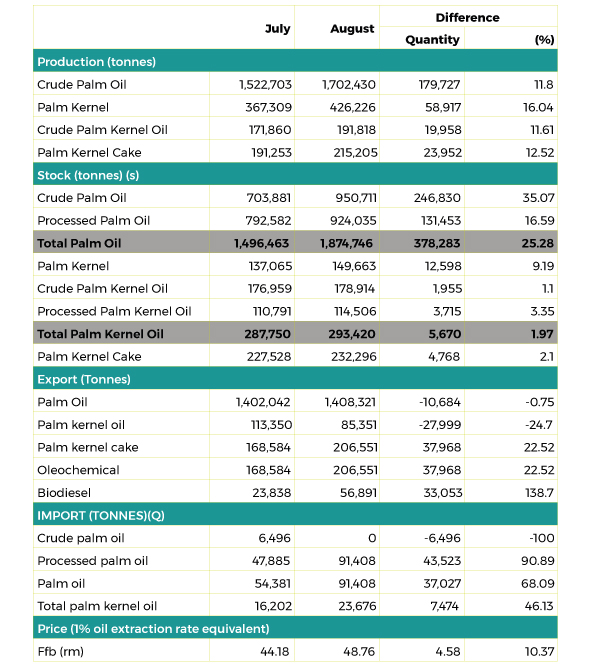

Performance of the Malaysian Palm Oil Industry, August 2021

Data from Malaysian Palm Oil Board

Soybeans

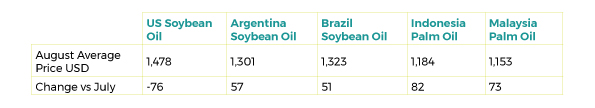

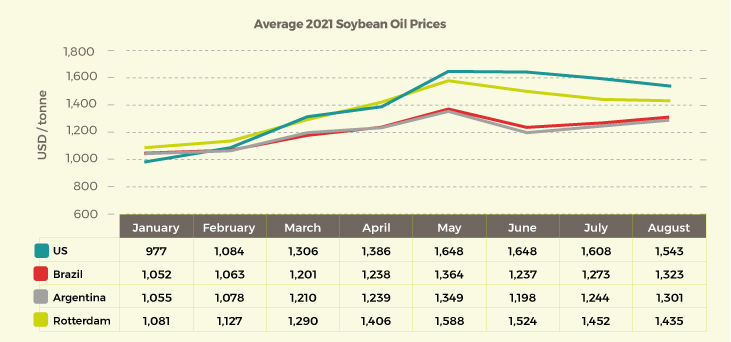

August 2021 Soybean and Palm Oil Export Prices $/tonne

- A decline in anticipated renewable diesel production and export demand contributed to a weaker US soybean oil market in August •

- Argentina and Brazil soybean oil prices benefited from buyers moving to cheaper South American supplies

- Palm oil supplies tend to trend with soybean oil prices, moving upwards with the strengthened South American market and tighter palm supplies

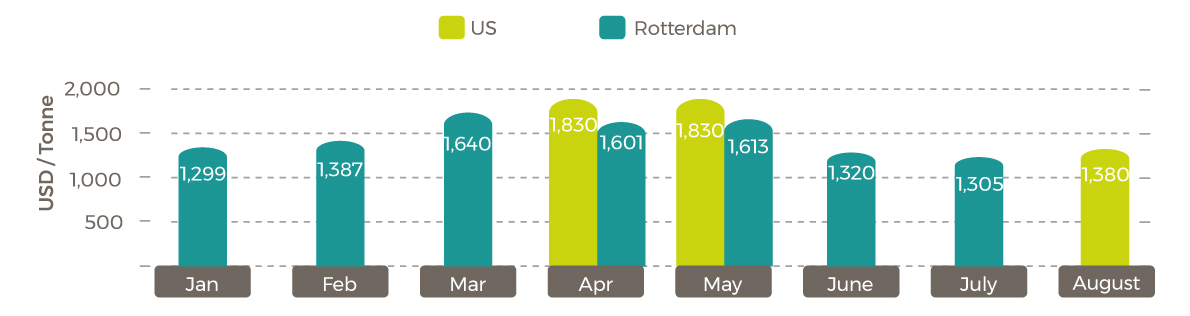

Rapeseed oil

Average 2021 Rapeseed Rotterdam (Canola) Oil Prices

Sunflower oil

Average July Soybean Oil Export Prices

McKinsey Global Institute update on shipping

Steven Saxon and Jaana Remes of McKinsey Global Institute gave a recent synopsis of contributions to the current shipping situation and what is expected going into 2022.

Their full analysis can be viewed here.

The current shipping situation:

- Historically, shipping a 40-foot container from Asia to North America or Europe would cost around $2,000. Currently costs are upwards of $12,000

- High prices are being driven by a

shift in consumer goods imports and transportation congestion - Globally, shipping demand is only up 5%since 2019

- Consumer spend is up on clothing (5%), furniture, household equipment (28%) and motor vehicles, parts (32%) from Q1 2019 to Q1 2021

- Consumer spend is down in recreation (-25%) and food, beverages and hotels (-11%)

- Key North American ports in Los Angeles and Long Beach receiving goods from Asia are seeing volumes up 40% since 2019

- On the ground infrastructure in North America and Europe, such as trucking and rail, are struggling to handle the influx

Drops in shipping supply

McKinsey Global Institute measures supply by the number of container ships that are sailing. Using its Deep Blue Tool, the company tracks every container ship in the world at any point in time whether it is sailing or not.

- In early 2020, their data shows capacity reduction as liners took ships off of water due to demand decrease related to COVID-19 disruptions

- By September 2020 had reached peak capacity with most ships sailing again as demand increased. Since then, capacity has dropped 11%

- Congestion in ports globally due to increase in demand and COVID-19 related illnesses impacting port labour

- April’s Suez Canal closure caused long-term repercussions in back logged shipping

- Yantian, one of the largest export ports in China, added to port congestion due to a COVID-19 outbreak. At one point in time more than 30 ships were lined up at the port. Capacity is back but still working through the backlog

Container liners are working to resolve this by increasing capacity

- Ordering more containers (which are in short supply)

- Trying to increase turnaround of container boxes

- Refusing export cargo from US and Europe for faster turnaround

- High level of new container ship ordering – which take 18 months to build

Looking ahead

- Sustained demand for consumer goods will continue in the medium term

- Shipping lines are going into peak season – August to November – as retailers stock up for Christmas

- Congestion bottlenecks expected to resolve into the new year as long as there are no further COVID-19 outbreaks in ports

Long term outlook

- Boom/bust cycling is not good for shipping lines or shippers with expectations of there being a shift in long-term contracting between shipping lines and shippers with enforceable contracts and volume commitments

- Container lines are adding capacity which should fully kick in within the next two years

Disclaimer:The information in this document has been obtained from or based upon sources believed to be reliable and accurate at the time of writing. The document should be for information purposes only and is not guaranteed to be accurate or complete.

VWFI Market Report Sept 22 2021

Palm prices increase despite being expected to remain firm throughout September